The Greatest Guide To Paul B Insurance

Wiki Article

Excitement About Paul B Insurance

The thought is that the cash paid in claims in time will certainly be much less than the total costs accumulated. You may seem like you're throwing money out the home window if you never sue, yet having item of mind that you're covered in case you do suffer a significant loss, can be worth its weight in gold.

Picture you pay $500 a year to guarantee your $200,000 residence. You have 10 years of making settlements, and you have actually made no claims. That comes out to $500 times 10 years. This indicates you've paid $5,000 for house insurance. You start to wonder why you are paying so much for absolutely nothing.

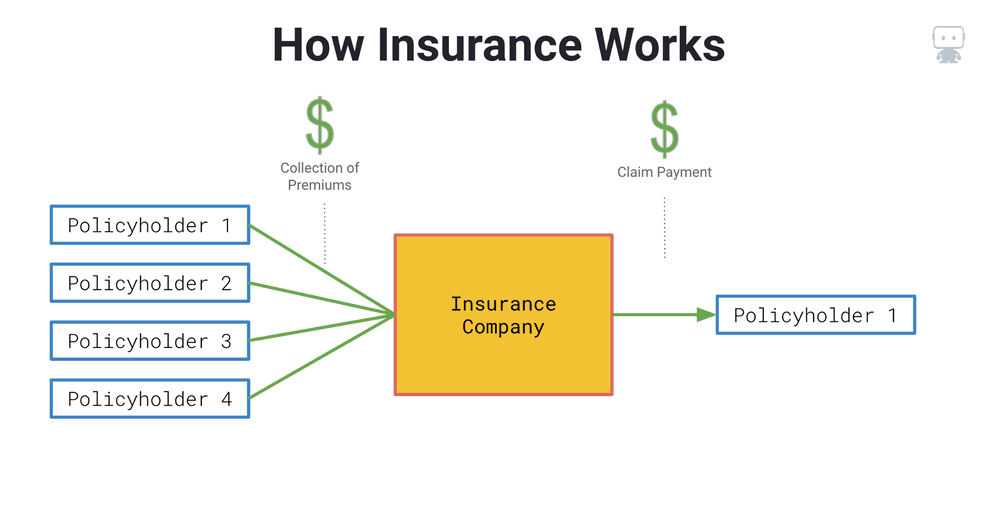

Because insurance coverage is based on spreading out the risk among lots of people, it is the pooled cash of all individuals paying for it that allows the company to construct possessions and also cover cases when they happen. Insurance policy is an organization. Although it would certainly behave for the companies to just leave rates at the very same degree at all times, the fact is that they need to make enough money to cover all the potential insurance claims their insurance holders might make.

Not known Factual Statements About Paul B Insurance

how a lot they obtained in premiums, they must change their rates to make money. Underwriting modifications and rate rises or reductions are based on outcomes the insurance provider had in past years. Depending upon what firm you purchase it from, you may be managing a captive representative. They offer insurance coverage from only one company.

The frontline people you take care of when you purchase your insurance coverage are the agents as well as brokers that stand for the insurance provider. They will describe the kind of items they have. The captive representative is a rep of only one insurance provider. They a knowledgeable about that company's items or offerings, yet can not talk towards other firms' policies, rates, or item offerings.

They will have accessibility to greater than one business and have to understand about the variety of items offered by all the firms they stand for. There are a couple of essential inquiries you can ask yourself that may help you determine what type of insurance coverage you require. Exactly how much risk or loss of cash can you presume by yourself? Do you have the cash to cover your prices or debts if you have a mishap? What concerning if your home or car is ruined? Do you have the cost savings to cover you if you can not function because of a mishap or health problem? Can you afford higher deductibles in order to minimize your prices? Do you have special requirements in your life that need additional insurance coverage? What problems you most? Policies can be customized to your demands as well as identify what you are most worried about safeguarding.

All About Paul B Insurance

The insurance coverage you need differs based upon where you are at in your life, what type of possessions you have, and also what your lengthy term objectives and obligations are. That's why it is important to put in the time to review what you want out of your plan with your agent.

If you secure a finance to purchase an auto, and afterwards something occurs to the automobile, space insurance coverage will repay any portion of your loan that common car insurance policy doesn't cover. Some loan providers require their borrowers to carry gap insurance.

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

The major objective of life insurance coverage is to give cash for your recipients when you pass away. Depending on the kind of policy you have, life insurance coverage can cover: Natural deaths.

read more

The Definitive Guide for Paul B Insurance

Life insurance policy covers the life of the insured individual. The insurance holder, that can be a various person or entity from the guaranteed, pays costs to an insurer. In return, the insurer pays a sum of cash to the beneficiaries listed on the policy. Term life insurance policy covers you for a period of time chosen at purchase, such as 10, 20 or three decades.

If you don't die during that time, no person earns money. Term life is prominent because it offers big payments at a lower expense than irreversible life. It also supplies protection for an established number of years. There are some variants of normal term life insurance policy plans. Convertible policies permit you to transform them to permanent life plans at a higher costs, enabling longer and potentially much more flexible coverage.

Long-term life insurance policy plans develop cash money worth as they age. A section of the costs repayments is included in the money value, which can make interest. go to this web-site The cash value of whole life insurance coverage policies grows at a set rate, while the cash value within universal policies can fluctuate. You can make use of the money value of your life insurance policy while you're still active.

Some Known Questions About Paul B Insurance.

If you compare typical life insurance policy rates, you can see the difference. As an example, $500,000 of entire life insurance coverage for a healthy 30-year-old female prices around $4,015 annually, typically. That same level of protection with a 20-year term life policy would certainly cost a standard of regarding $188 yearly, according to Quotacy, a broker agent firm.

Nonetheless, those investments feature more risk. Variable life is another long-term life insurance policy choice. It seems a great deal like variable global life but is really different. It's an alternative to whole life with a fixed payment. However, insurance policy holders can use investment subaccounts to expand the money worth of the plan.

Right here are some life insurance fundamentals to aid you better recognize exactly how insurance coverage works. For term life plans, these cover the cost of your insurance and also administrative expenses.

ContinueReport this wiki page